It is sometimes called net assets, because it is equivalent to assets minus liabilities for a particular business. ” The answer to this question depends on the legal form of the entity; examples of entity types include sole proprietorships, partnerships, and corporations. A sole proprietorship is a business owned by one person, and its equity would typically consist of a single owner’s capital account. Conversely, a partnership is a business owned by more than one person, with its equity consisting of a separate capital account for each partner. Finally, a corporation is a very common entity form, with its ownership interest being represented by divisible units of ownership called shares of stock. Corporate shares are easily transferable, with the current holder(s) of the stock being the owners.

What Are the 3 Elements of the Accounting Equation?

- The term capital includes the capital introduced by the business owner plus or minus any profits or losses made by the business.

- Using Apple’s 2023 earnings report, we can find all the information we need for the accounting equation.

- This shows all company assets are acquired by either debt or equity financing.

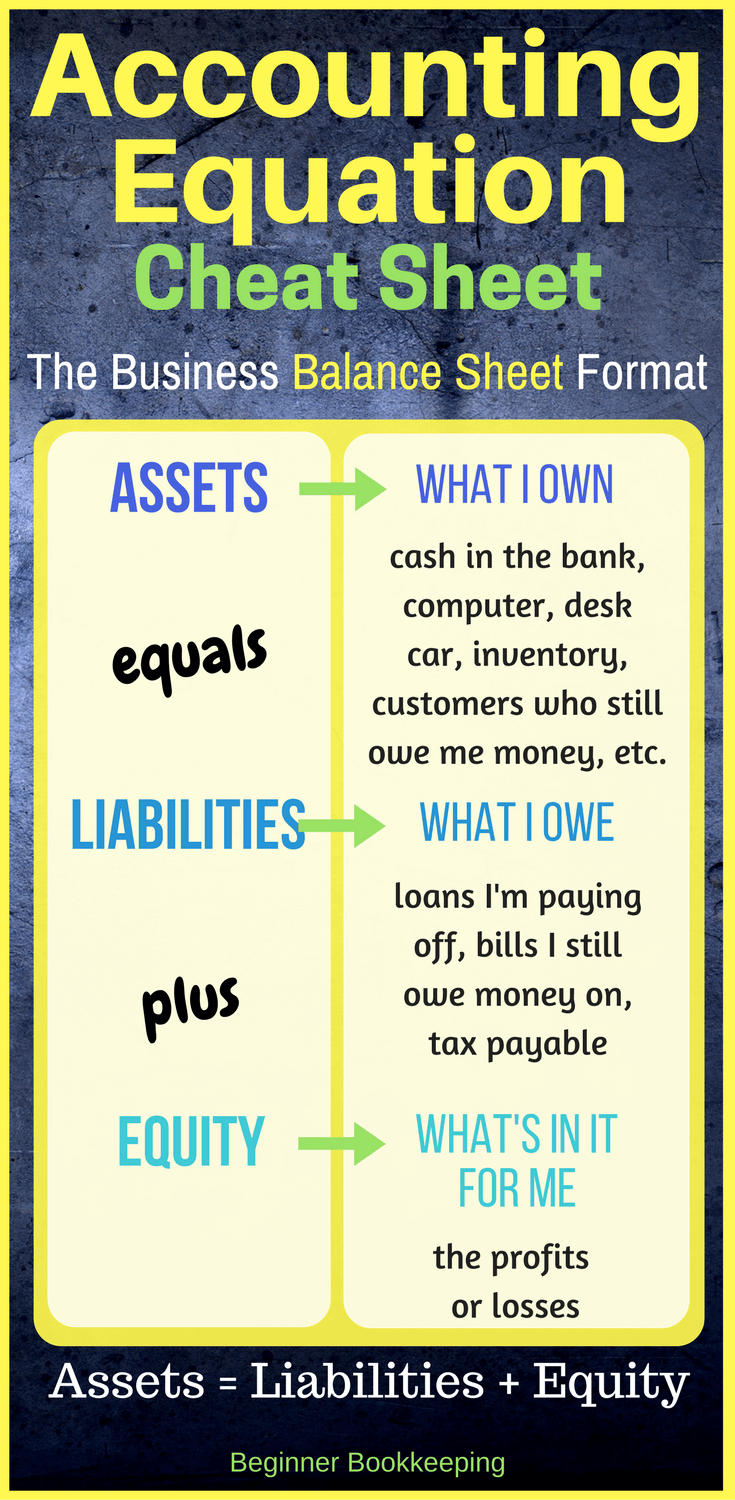

- The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time.

- Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash).

- Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage.

The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system. The primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation. It is based on the idea that each transaction has an equal effect. It is used to transfer totals from books of prime entry into the nominal ledger.

When Should I Use the Basic Accounting Equation?

The balance sheet is one of the three main financial statements that depicts a company’s assets, liabilities, and equity sections at a specific point in time (i.e. a “snapshot”). This straightforward relationship between assets, liabilities, and equity is the foundation of the double-entry accounting system. That is, each entry made on the Debit side has a corresponding entry on the Credit side. It’s a tool used by company leaders, investors, and analysts that better helps them understand the business’s financial health in terms of its assets versus liabilities and equity.

Everything You Need To Master Financial Modeling

That’s why you’re better off starting with double-entry bookkeeping, even if you don’t do much reporting beyond a standard profit and loss statement. Additionally, you can use your cover letter to detail other experiences you have with the accounting equation. For example, you can talk about a time you balanced the books for a friend or family member’s small business. In Double-Entry Accounting, there are at least two sides to every financial transaction. Every accounting entry has an opposite corresponding entry in a different account. This principle ensures that the Accounting Equation stays balanced.

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Metro Corporation earned a total of $10,000 in service revenue from clients who will pay in 30 days. Metro purchased supplies on account from Office Lux for $500. Simply put, the rationale is that the assets belonging to a company must have been funded somehow, i.e. the money used to purchase the assets did not just appear out of thin air to state the obvious. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Company

Taking time to learn the accounting equation and to recognise the dual aspect of every transaction will help you to understand the fundamentals of accounting. Whatever happens, the transaction will always result in the accounting equation balancing. Anushka will record revenue (income) of $400 for the sale made. A trade receivable (asset) will be recorded to represent Anushka’s right to receive $400 of cash from the customer in the future.

In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings. This then allows them to predict future profit trends and adjust business practices accordingly. Thus, the accounting equation is an essential step in determining company profitability.

Assets include cash and cash equivalents or liquid assets, which may include Treasury bills and certificates of deposit (CDs). Below is a portion of Exxon Mobil Corporation’s (XOM) balance sheet as of September 30, 2018. By decomposing equity into component parts, analysts can get a better idea of how profits are being used—as dividends, reinvested into the company, or retained as cash. Debits and Credits are the words used to reflect this double-sided nature of financial transactions. Liabilities are the stuff that a business owes to third parties.

In the coming sections, you will learn more about the different kinds of financial statements accountants generate for businesses. On the other hand, double-entry accounting records transactions in a way that demonstrates how profitable a company is becoming. Investors are interested in a business’s cash flow compared to its liability, which reflects current debts and bills. The shareholders’ equity number is a company’s total assets minus its total liabilities. Like any mathematical equation, the accounting equation can be rearranged and expressed in terms of liabilities or owner’s equity instead of assets. To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation.

It is central to understanding a key financial statement known as the balance sheet (sometimes called the statement of financial position). The following illustration for Edelweiss Corporation shows a variety of assets that are reported at a total of $895,000. Creditors xero certification for accountants are owed $175,000, leaving $720,000 of stockholders’ equity. Income and expenses relate to the entity’s financial performance. Individual transactions which result in income and expenses being recorded will ultimately result in a profit or loss for the period.