Assets typically hold positive economic value and can be liquified (turned into cash) in the future. Some assets are less liquid than others, making them harder to convert to cash. For instance, inventory is very liquid — the company can quickly sell it for money. Real estate, though, is less liquid — selling land or buildings for cash is time-consuming and can be difficult, depending on the market. This number is the sum of total earnings that were not paid to shareholders as dividends. It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities.

Impact of transactions on accounting equation

In this example, we will see how this accounting equation will transform once we consider the effects of transactions from the first month of Laura’s business. The combined balance of liabilities and capital is also at $50,000. Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. Likewise, revenues increase equity while expenses decrease equity. When a company purchases goods or services from other companies on credit, a payable is recorded to show that the company promises to pay the other companies for their assets. A liability, in its simplest terms, is an amount of money owed to another person or organization.

What Are the Key Components in the Accounting Equation?

A company’s “uses” of capital (i.e. the purchase of its assets) should be equivalent to its “sources” of capital (i.e. debt, equity). The Accounting Equation is a fundamental principle that states assets must equal the sum of liabilities and shareholders equity at all times. On 28 January, merchandise costing $5,500 are destroyed by fire. The effect of this transaction on the accounting equation is the same as that of loss by fire that occurred on January 20. On 10 January, Sam Enterprises sells merchandise for $10,000 cash and earns a profit of $1,000. As a result of this transaction, an asset (i.e., cash) increases by $10,000 while another asset ( i.e., merchandise) decreases by $9,000 (the original cost).

Income and retained earnings

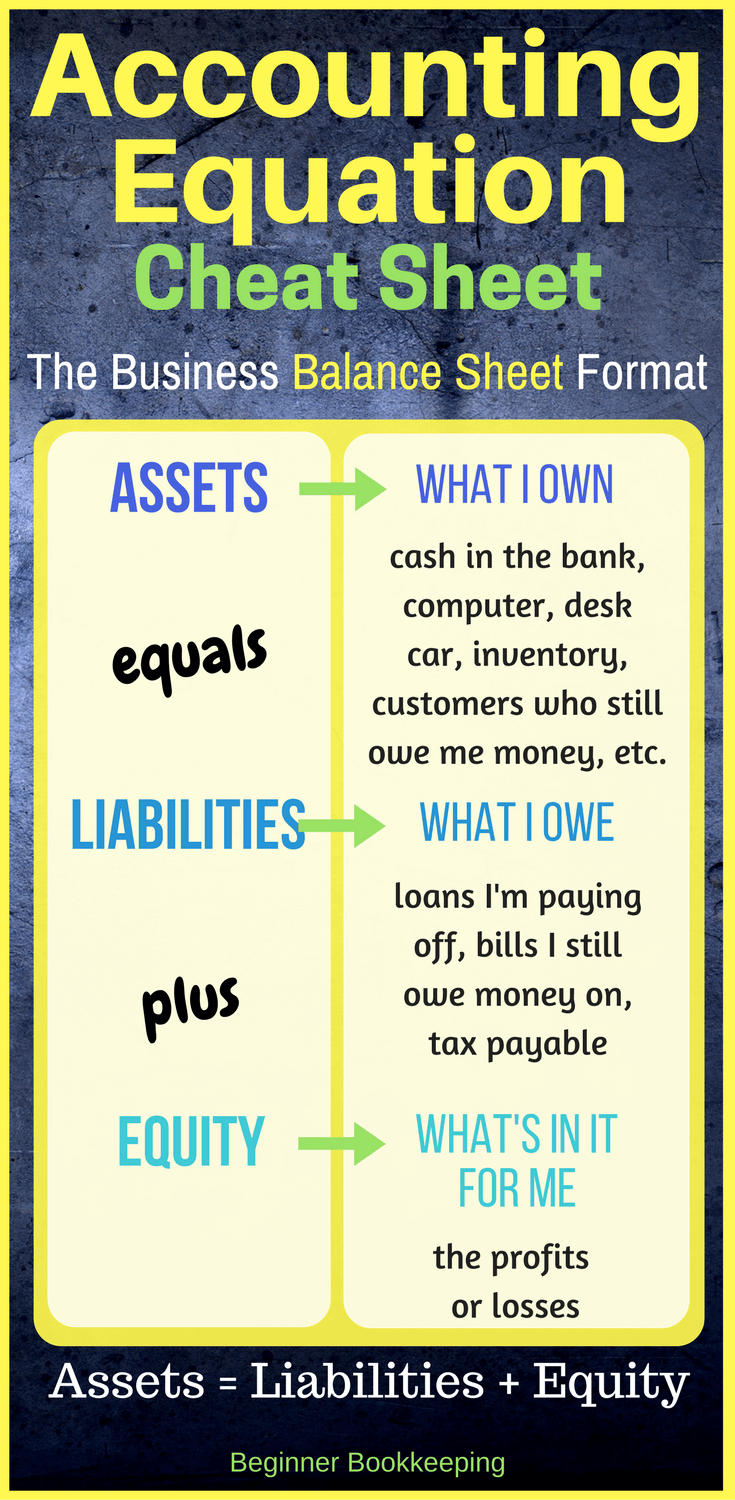

From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity. Because it considers assets, liabilities, and equity (also known as shareholders’ equity or owner’s equity), this basic accounting equation is the basis of a business’s balance accounting software sheet. The expanded accounting equation is a form of the basic accounting equation that includes the distinct components of owner’s equity, such as dividends, shareholder capital, revenue, and expenses. The expanded equation is used to compare a company’s assets with greater granularity than provided by the basic equation.

Each entry on the debit side must have a corresponding entry on the credit side (and vice versa), which ensures the accounting equation remains true. In all financial statements, the balance sheet should always remain in balance. An asset can be cash or something that has monetary value such as inventory, furniture, equipment etc. while liabilities are debts that need to be paid in the future. For example, if you have a house then that is an asset for you but it is also a liability because it needs to be paid off in the future. This transaction would reduce cash by $9,500 and accounts payable by $10,000.

- Like any mathematical equation, the accounting equation can be rearranged and expressed in terms of liabilities or owner’s equity instead of assets.

- The company acquired printers, hence, an increase in assets.

- Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill.

- This transaction also generates a profit of $1,000 for Sam Enterprises, which would increase the owner’s equity element of the equation.

Accounting Equation Components

In other words, the total amount of all assets will always equal the sum of liabilities and shareholders’ equity. The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet. This is how the accounting equation of Laura’s business looks like after incorporating the effects of all transactions at the end of month 1.

Remember that capital is increased by contribution of owners and income, and is decreased by withdrawals and expenses. As you can see, assets equal the sum of liabilities and owner’s equity. This makes sense when you think about it because liabilities and equity are essentially just sources of funding for companies to purchase assets.

Along with Equity, they make up the other side of the Accounting Equation. The formula defines the relationship between a business’s Assets, Liabilities and Equity. Before taking this lesson, be sure to be familiar with the accounting elements. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.