Mastering Pocket Option Trader: A Comprehensive Guide

Pocket Option трейдер offers a dynamic platform for investors eager to delve into the world of options trading. As the trading landscape becomes increasingly digital, platforms like Pocket Option provide unique opportunities and tools that can cater to both beginners and advanced traders. In this comprehensive guide, we explore key features, strategies, and insights to help you master Pocket Option Trader.

What is Pocket Option Trader?

Pocket Option Trader is a digital options trading platform that allows users to speculate on the price of assets over a set period. Unlike traditional trading, options trading on this platform requires strategic thinking and precise timing, which can lead to high returns if executed correctly. The platform is designed with user-friendly interfaces and intuitive tools to facilitate both novice and experienced traders.

Key Features of Pocket Option Trader

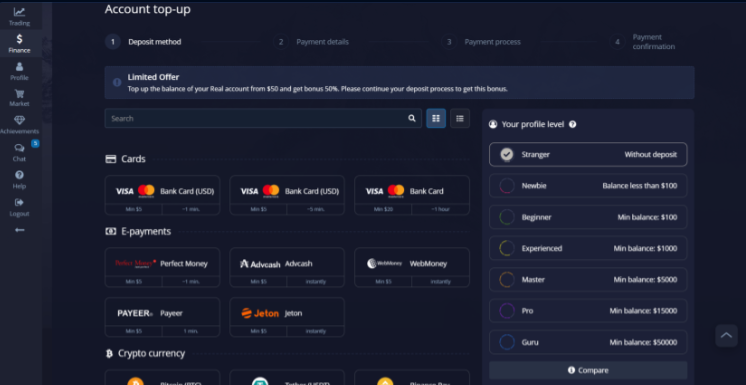

1. User-Friendly Interface

One of the standout features of Pocket Option Trader is its simplicity in design, making it accessible to users who are new to trading. The platform presents data in a clear and concise manner, ensuring that traders can make informed decisions without unnecessary clutter.

2. Diverse Asset Selection

Users have access to a wide array of assets, including currencies, commodities, stocks, and indices. This diversity allows traders to diversify their portfolios and mitigate risks associated with trading a single asset class.

3. Low Minimum Investments

Pocket Option Trader has low entry barriers, allowing users to start trading with minimal capital. This feature is particularly attractive to beginners who wish to enter the market without significant financial commitments.

4. Advanced Charting Tools

For traders who prefer technical analysis, the platform provides sophisticated charting tools. These tools offer various indicators and drawing tools that help users predict market movements and plan their trades effectively.

Developing a Pocket Option Trading Strategy

While the platform itself is robust, success in trading largely depends on the strategies employed by traders. Here are some strategies that may enhance your trading experience:

Trend Following

This strategy involves identifying the general direction of the market and making trades that align with the trend. If the market is trending upwards, traders might look to buy, whereas a downward trend could signal a selling opportunity. Trend following relies heavily on technical indicators such as moving averages and trend lines to confirm the market’s direction.

Range Trading

Range trading is applicable in markets that do not exhibit clear directional movements. Traders use support and resistance levels to make their trades. Buying occurs at the support level with the expectation of selling at the resistance level, and vice versa.

Breakout Strategy

The breakout strategy focuses on entering the market at the early stage of a new trend. This typically occurs when the market breaks through established support or resistance levels. Traders using this strategy need to be adept at recognizing potential breakouts and acting promptly to capitalize on them.

News-Based Trading

Economic news and world events can significantly impact asset prices. Staying informed about relevant news can provide opportunities to make swift trades based on anticipated market reactions. This strategy requires a good understanding of fundamental analysis and the potential impact of news on various financial instruments.

Risk Management in Pocket Option Trader

The volatility inherent in options trading requires robust risk management strategies. Traders must be vigilant and prepared for the unpredictability of the markets. Here are some risk management techniques to consider:

Setting Stop-Loss Orders

A stop-loss order allows traders to minimize losses by setting a predetermined exit point. If the market moves against the trade, the stop-loss ensures that losses are capped at a manageable level.

Position Sizing

Proper position sizing is crucial to ensure that no single trade excessively impacts the trader’s overall portfolio. Diversifying investments across multiple trades and not risking more than a small percentage of the account balance on any single trade can help manage risk.

Emotion Management

Trading can be emotionally taxing, especially during periods of high market volatility. Traders should cultivate discipline and a clear mindset, avoiding decisions driven by fear or greed. Following a well-defined trading plan can help maintain emotional stability.

Conclusion

Pocket Option Trader opens up a world of possibilities for traders, providing access to a wide range of assets and tools that facilitate active trading strategies. Whether you are a novice or an experienced trader, understanding the platform’s features and developing robust trading and risk management strategies are essential to achieving success.

Incorporating advanced strategies like trend following, range trading, and breakout strategies can enhance your ability to capitalize on market movements and achieve your financial goals. Always remember that the key to successful trading lies in a disciplined approach, continuous education, and adaptability to changing market conditions.